UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

| | | | | | | | | | |

Filed by the Registrant x ☒ | | Filed by a Party other than the Registrant ☐ | |

Check the appropriate box:

|

| | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

SELECTA BIOSCIENCES, INC.

(Name of Registrant as Specified in itsIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

|

| | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box) |

x☒ | | | | | No fee required. |

| ☐ | | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| ☐ | | | | Fee paid previously with preliminary materials. |

| ☐ | | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

|

| | |

| | |

| Selecta Biosciences, Inc. | |

| | |

| PROXY STATEMENT | |

| | |

| Annual Meeting of Stockholders |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| June 14, 2019 | |

| 9:00 am (Eastern Time) | |

SELECTA BIOSCIENCES, INC.

480 ARSENAL WAY

WATERTOWN, MASSACHUSETTS 02472

SELECTA BIOSCIENCES, INC.

65 Grove Street

Watertown, Massachusetts 02472

April 29, 2019

To Our Stockholders:

You are cordially invited to attend the 20192021 Annual Meeting of Stockholders of Selecta Biosciences, Inc. (the "Company"“Company”) to be held on Friday, June 14, 201918, 2021 at 9:10:00 a.m., Eastern Time. We are very pleased that our Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SELB2019.SELB2021. You will also be able to vote your shares electronically at the Annual Meeting.

We will be using the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate from any location.

The Notice of Annual Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Details regarding how to attend the meeting online and the business to be conducted at the Annual Meeting are more fully described in the Notice of Annual Meeting of Stockholders and Proxy Statement. Please see the section called “Who Can Attend the 20192021 Annual Meeting of Stockholders?Meeting?” on page 3 of the Proxy Statement for more information.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the online Annual Meeting, you will be able to vote your shares electronically, even if you have previously submitted your proxy.

On behalf of the Board of Directors, thank you for your continued support and investment in Selecta Biosciences, Inc.

Sincerely,

/s/ Carsten Brunn, Ph.D.

Carsten Brunn, Ph.D.

President and Chief Executive Officer

| | | | | | | | |

| | Sincerely, |

| | |

| April 29, 2021 | | /s/ Carsten Brunn, Ph.D. |

| | Carsten Brunn, Ph.D. |

| | President and Chief Executive Officer, and Director |

| | |

Table of Contents

Table of Contents| Page |

| | |

| |

| | |

| | |

Proxy Statement | 1 |

| Proposals | 1 |

| Recommendations of the Board | 2 |

| Information About This Proxy Statement | 2 |

| | |

| 3 |

| | |

Proposals to be Voted On | 7 |

| Proposal 1: Election of Directors | 7 |

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 11 |

| | |

| |

| | |

| |

| | |

Executive Officers | |

| | |

Corporate Governance | 17 |

| General | 17 |

| Board Composition | 17 |

| Director Independence | 17 |

| Director Candidates | 17 |

| Communications from Stockholders | 18 |

| Board Leadership Structure and Role in Risk Oversight | 18 |

| Annual Board Evaluation | 19 |

| Code of Ethics | 19 |

| Anti-Hedging Policy | 19 |

| Attendance by Members of the Board of Directors at Meetings | 19 |

| | |

Committees of the Board | 21 |

| Audit Committee | 21 |

| Compensation Committee | 22 |

| Nominating and Corporate Governance Committee | 23 |

| Science Committee | 23 |

| | |

| 24 |

| Executive Compensation | 24 |

| 2018 Summary Compensation Table | 24 |

| Narrative Disclosure to Compensation Table | 25 |

| Outstanding Equity Awards at 2018 Fiscal Year-End | 27 |

| Employment and Separation Agreements | 27 |

| Director Compensation | 29 |

|

| | |

Certain Relationships | 35 |

| | |

Section 16(a) Beneficial Ownership Reporting Compliance | 37 |

| | |

Compensation Committee Interlocks and Insider Participation | 38 |

| | |

Stockholders' Proposals | 38 |

| | |

Other Matters | 39 |

| | |

| 40 |

| | |

| 41 |

Notice of Annual Meeting of Stockholders

To Be Held Friday, June 14, 2019

SELECTA BIOSCIENCES, INC.

480 ARSENAL WAY65 Grove Street

WATERTOWN, MASSACHUSETTSWatertown, Massachusetts 02472

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

To be held June 18, 2021

The Annual Meeting of Stockholders (the “Annual Meeting”) of Selecta Biosciences, Inc., a Delaware corporation (the “Company”), will be held at 9:10:00 a.m., Eastern Time, on Friday, June 14, 2019,18, 2021, by virtual meeting online at www.virtualshareholdermeeting.com/SELB2019,SELB2021, for the following purposes:

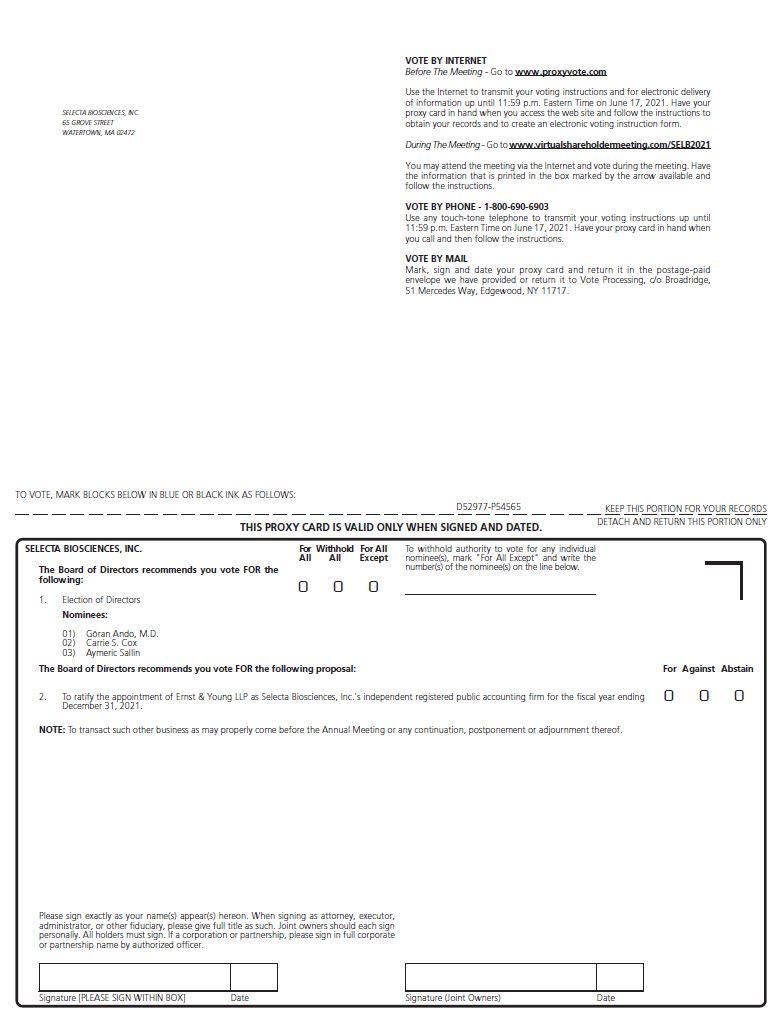

1.To elect Göran Ando, M.D., Carrie S. Cox, and Aymeric Sallin as Class II Directors to serve until the 2024 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; |

| |

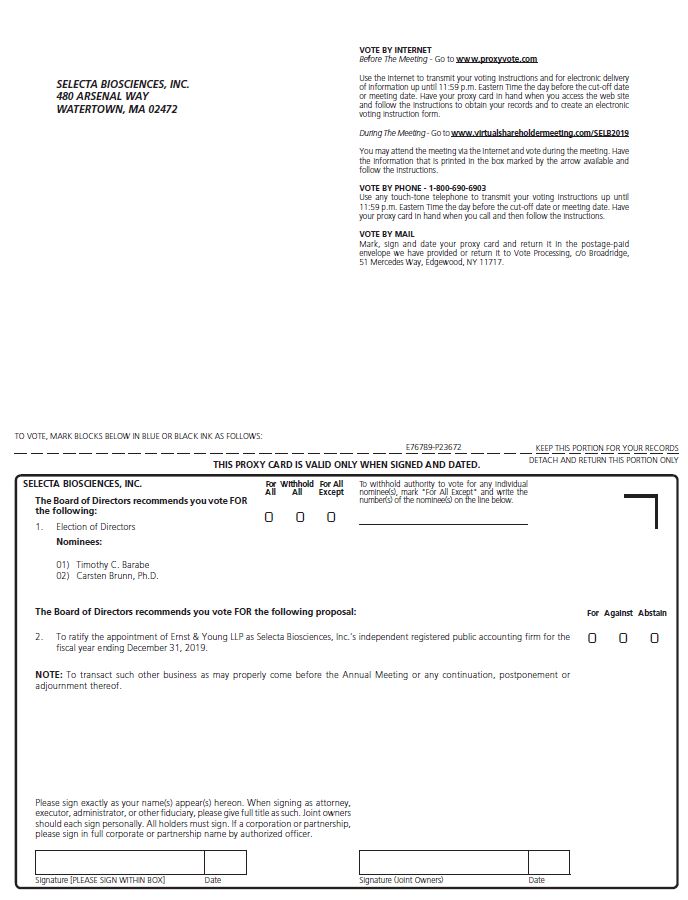

| To elect Timothy C. Barabe and Carsten Brunn, Ph.D. as Class III Directors to serve until the 2022 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; |

2.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and3.To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

| |

| To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

|

| |

| To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

Holders of record of our Common Stockcommon stock as of the close of business on April 17, 201921, 2021 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of these stockholders will be open to the examination of any stockholder at our principal executive offices at 480 Arsenal Way, Watertown, Massachusetts 02472 for a period of ten days prior to the Annual Meeting.Meeting for a purpose germane to the meeting by sending an email to ShareholderRequests@selectabio.com, stating the purpose of the request and providing proof of ownership of Company stock. The list of these stockholders will also be available on the bottom panel of your screen during the meeting at www.virtualshareholdermeeting.com/SELB2019SELB2021 after entering the 16 digit16-digit control number included on the Notice of Internet Availability of Proxy Materials or any proxy card that you received, or on the materials provided by your bank or broker. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the online Annual Meeting webcast, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Note that, in light of possible disruptions in mail service related to the novel coronavirus outbreak, we encourage stockholders to submit their proxy via telephone or over the Internet. Submitting your proxy now will not prevent you from voting your shares electronically at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

| | | | | |

|

|

| |

| By order of the Board of Directors, |

| |

| /s/ Elona KoganCarsten Brunn, Ph.D. |

Elona Kogan | Carsten Brunn, Ph.D. |

General Counsel | President and Secretary of Selecta Biosciences, Inc.Chief Executive Officer, Director |

| |

| Watertown, Massachusetts |

| April 29, 2019 |

Proxy Statement

SELECTA BIOSCIENCES, INC.

480 ARSENAL WAY65 Grove Street

WATERTOWN, MASSACHUSETTSWatertown, Massachusetts 02472

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board of Directors”) of Selecta Biosciences, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Friday, June 14, 201918, 2021 (the “Annual Meeting”), by virtual meeting online at www.virtualshareholdermeeting.com/SELB2019 at 9:10:00 a.m., Eastern Time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/SELB2021 and entering your 16-digit control number included on your Notice of Internet Availability of Proxy Materials (the “Internet Notice”), on your proxy card or on the instructions that accompanied your proxy materials. Holders of record of shares of Common Stock,common stock, $0.0001 par value (“Common Stock”), as of the close of business on April 17, 201921, 2021 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 44,788,025113,193,597 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 20182020 (the “2018“2020 Annual Report”) will be released on or about April 29, 20192021 to our stockholders on the Record Date.

In this proxy statement, “Selecta”, “Company”, “we”, “us”, and “our” refer to Selecta Biosciences, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON FRIDAY, JUNE 14, 201918, 2021

This Proxy Statement and our 20182020 Annual Report are available at http://www.proxyvote.com

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

1.To elect Göran Ando, M.D., Carrie S. Cox, and Aymeric Sallin as Class II Directors to serve until the 2024 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; |

| |

| To elect Timothy C. Barabe and Carsten Brunn, Ph.D. as Class III Directors to serve until the 2022 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; |

2.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and3.To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

| |

| To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

|

| |

| To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

WeStockholders at an annual meeting will only be able to consider proposals or nominations specified in the Notice of Annual Meeting or brought before the meeting by or at the direction of our Board of Directors or by a stockholder of record on the Record Date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our Secretary of the stockholder’s intention to bring such business before the meeting. As of the date of this proxy statement, we know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD

The Board of Directors (the “Board”) recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf

as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted in accordance with the recommendations of the Board of Directors. The Board of Directors recommends that you vote:

1.FOR the election of Göran Ando, M.D., Carrie S. Cox, and Aymeric Sallin as Class II Directors; and

|

| |

| FOR the election of Timothy C. Barabe and Carsten Brunn, Ph.D. as Class III Directors; and |

|

| |

| FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. |

2.FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

INFORMATION ABOUT THIS PROXY STATEMENT

Why you received this proxy statementProxy Statement. You are viewing or have received these proxy materials because Selecta’s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, Selecta is making this proxy statement and its 20182020 Annual Report available to its stockholders electronically via the Internet. On or about April 29, 2019,2021, we mailed to our stockholders aan Internet Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 20182020 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 20182020 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at (866) 540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and received more than one copy of proxy materials, but wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

Questions and Answers about the 20192021 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting? The Record Date for the Annual Meeting is April 17, 2019.21, 2021. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 44,788,025113,193,597 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”? A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”? Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, please refer to the information from your bank, broker or other nominee on how to submit your voting instructions.

How many shares must be present to hold the Annual Meeting? A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, onlinein person, or by remove communication, or represented by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the 20192021 Annual Meeting?Meeting? You may attend the online Annual Meeting only if you are a Selecta stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. The Annual Meeting will be held entirely online to allow greater participation. You will be able to attend the Annual Meeting online and submit your questions by visitingwww.virtualshareholdermeeting.com/SELB2019SELB2021. You also will be able to vote your shares electronically at the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 9:10:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:9:55 a.m., Eastern Time, and you should allow ample time for the check-in procedures. If your shares are held in street name and you did not receive a 16-digit control number, you may gain access to and vote at the Annual Meeting by logging into your bank or brokerage firm'sfirm’s website and selecting the shareholder communications mailbox to access the meeting. The control number will automatically populate. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm. If you lose your 16-digit control number, you may join the Annual Meeting as a "Guest,"“Guest,” but you will not be able to vote, ask questions, or access the list of stockholders as of the Record Date.

WHY A VIRTUAL MEETING?Why a virtual meeting?We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company.Company while providing stockholders with the same rights and opportunities to participate as they would have at an in-person meeting. Hosting a virtual meeting will enable increased stockholder attendance and participation since stockholders can participate from any location around the world. Furthermore, as part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, in light of the novel coronavirus disease, COVID-19, we believe that hosting a virtual meeting is in the best interest of the Company and its stockholders. You will be able to attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/SELB2019SELB2021. You also will be able to vote your shares electronically at the Annual Meeting.

WHAT IF DURING THE CHECK-IN TIME OR DURING THE ANNUAL MEETING I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE VIRTUAL MEETING WEBSITE?Table of ContentsWhat if during the check-in time or during the annual meeting I have technical difficulties or trouble assessing the virtual meeting website? We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

What if a quorum is not present at the Annual Meeting? If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting may adjourn the Annual Meetinguntil a quorum is present or represented.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

Stockholders of Record.We recommend that stockholders vote by proxy even if they plan to participate in the online Annual Meeting and vote electronically during the meeting. If you are a stockholder of record, there are three ways to vote by proxy:you may vote: •by Telephone - You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

•by Internet - You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card;card or Internet Notice;

•by Mail - You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail.

mail; or

•Electronically at the Meeting - You may vote at the Annual Meeting by visiting www.virtualshareholdermeeting.com/SELB2021 and entering the 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 10:00 am, Eastern Time, on June 18, 2021.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on June 13, 2019. Stockholders may vote at17, 2021. To participate in the Annual Meeting, by visiting www.virtualshareholdermeeting.com/SELB2019 and enteringincluding to vote via the Internet or telephone, you will need the 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The meeting webcast will begin

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at 9:00 am, Eastern Time on June 14, 2019.the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically. Note that, in light of possible disruptions in mail service related to the COVID-19 pandemic, we encourage stockholders to submit their proxy via the Internet or telephone.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in street name“street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Telephone and Internet voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are held in street name and you would like to vote at the Annual Meeting, you may visit www.virtualshareholdermeeting.com/SELB2019SELB2021 and enter the 16-digit control number included in the voting instruction card provided to you by your bank or brokerage firm.firm or otherwise vote through the bank or broker. If you holdlose your shares in street name and you did not receive a 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to log inobtain your own Internet access if you choose to your bank attend the Annual Meeting online and/or brokerage firm's website and selectvote over the shareholder communications mailbox to access the meeting and vote. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm.

Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of the Company prior to or at the Annual Meeting; or

•by voting electronically at the online Annual Meeting.

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your participation in the online Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote electronically at the online Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote electronically at the online Annual Meeting by following the instructions above.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are indicated on page 2 of this proxy statement,Proxy Statement, as well as with the description of each proposal in this proxy statement.

Proxy Statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

|

| | |

| Proposal | Votes required | Effect of Votes

Withheld/Abstentions and

Broker Non-Votes |

| Proposal 1: Election of Directors | The plurality of the votes cast. This means that the twothree nominees receiving the

highest number of affirmative “FOR” votes will be elected as Class IIIII Directors.

| Votes withheld and broker non-votes will have no effect.

|

| | |

Proposal 2: Ratification of Appointment

of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority

in voting power of the votes cast affirmatively or negatively.

| Abstentions will have no effect. We do not expect any broker non-votes on this proposal.

|

What is an abstention and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the proposal regarding the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors and abstentions have no effect on the ratification of the appointment of Ernst & Young LLP.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the 20192021 Annual Meeting of Stockholders?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC within four business days of the Annual Meeting.

PROPOSALS TO BE VOTED ON - PROPOSAL 1 - Election Of Directors

At the Annual Meeting, two (2)three (3) Class IIIII Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 20222024 and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal.

We currently have seven (7)eight (8) directors on our Board, including two (2)three (3) Class IIIII Directors. Our current Class IIIII Directors are Carsten Brunn, Ph.D.Göran Ando, M.D., who was appointed to serve on our Board of Directors in December 2018,April 2020, Carrie S. Cox, who was appointed to serve on our Board of Directors in November 2019, and Timothy C. Barabe,Aymeric Sallin, who has served on our Board of Directors since 2016. Both2008. All three members have been nominated for election as a Class IIIII Director at the Annual Meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the twothree nominees receiving the highest number of affirmative “FOR” votes will be elected as Class IIII Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

As set forth in our Restated Certificate of Incorporation, the Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The current class structure is as follows: Class I, whose current term will expireexpires at the 20202023 Annual Meeting of Stockholders and whose subsequent term will expire at the 20232026 Annual Meeting of Stockholders; Class II, whose current term will expireexpires at the 2021 Annual Meeting, of Stockholders and whose subsequent term will expire at the 2024 Annual Meeting of Stockholders; and Class III, whose current term expires at the Annual Meeting and whose new term will expire at the 2022 Annual Meeting of Stockholders and whose subsequent term will expire at the 2025 Annual Meeting of Stockholders. The current Class I Directors are Scott D. Myers, Timothy Springer, Ph.D. and Patrick Zenner; the current Class II Directors are Omid Farokhzad,Göran Ando, M.D., Amir Nashat, Ph.D.Carrie S. Cox, and Aymeric Sallin; and the current Class III Directors are Timothy C. Barabe and Carsten Brunn, Ph.D.

Our Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two thirds of our outstanding voting stock entitled to vote in the election of directors.

There are no family relationships among any of our executive officers or directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented thereby for the election as Class IIIII Directors of the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board may elect to reduce its size. The Board of Directors has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

Vote required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the twothree nominees receiving the highest number of affirmative “FOR” votes will be elected as Class IIIII Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board of Directors

RECOMMENDATION OF THE BOARD OF DIRECTORSThe Board of Directors unanimously recommends a vote FOR the election of the below Class II Director nominees.

|

| |

Ü | The Board of Directors unanimously recommends a vote FOR the election of the below Class III Director nominees. |

NOMINEES FOR CLASS III DIRECTORS (TERMS TO EXPIRE AT THE 2022 ANNUAL MEETING)

Nominees for Class II Directors (Terms to Expire at 2024 Annual Meeting of Stockholders) The nominees for election to the Board of Directors as Class IIIII Directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Served as a Director Since | | Position(s) with Selecta |

| Göran Ando, M.D. | | 72 | | 2020 | | Director |

| Carrie S. Cox | | 64 | | 2019 | | Chairman of the Board |

| Aymeric Sallin | | 47 | | 2008 | | Director |

|

| | | | | |

| Name | | Age | | Served as a Director Since | Position(s) with Selecta |

| Timothy C. Barabe | | 66 | | 2016 | Director |

| Carsten Brunn, Ph.D. | | 48 | | 2018 | President and Chief Executive Officer |

The principal occupations and business experience, for at least the past five years, of each Class III nominee for election at the Annual MeetingII Director are as follows:

|

| | | | | | | | | | |

| TIMOTHY C. BARABEGÖRAN ANDO, M.D. | Age | 6672 |

Göran Ando, M.D. has served as Chairman of the board of directors of EyePoint Pharmaceuticals, Inc., a public pharmaceutical company, since September 2018, as Vice-Chairman of the board of directors of Molecular Partners AG, a clinical-stage biopharmaceutical company, since April 2011, and on the board of directors of Molecular Partners AG since April 2011. In March 2018, he retired as Chairman of Novo Nordisk A/S, a multinational pharmaceutical company, a position he had held since 2013, after serving as Vice Chair of the board of directors since 2006, and serving on the board of directors since 2005. Dr. Ando previously served as the Chief Executive Officer of Celltech Group plc. from 2003 to 2005. Before that, he served as Executive Vice President and Deputy Chief Executive Officer of Pharmacia ABuntil its acquisition by Pfizer, Inc. in 2003. Prior to Pharmacia, he held various senior appointments at Glaxo, now GlaxoSmithKline plc, including Research and Development Director for Glaxo Group Research. He has also been a Senior Advisor at EW Healthcare Partners since 2007. Dr. Ando received his Bachelor of Arts degree from Uppsala University in Sweden and Doctor of Medicine degree from Linköping University in Sweden. Dr. Ando’s extensive experience as an executive officer and director in the life sciences industry and knowledge of manufacturing, information technology, business development and commercialization contributed to our Board’s conclusion that he should serve as a director of the Company.

Carrie S. Cox has served as a member of our Board of Directors and as chairman of the Board of Directors since November 2019. Ms. Cox most recently served as the Chief Executive Officer of Humacyte, Inc., a regenerative medicine company based in July 2016. Mr. Barabe also servesDurham, North Carolina, from 2010 to June 2018, and has served as a member of its board of directors since 2010, serving as chairman from 2011 to June 2019. Ms. Cox has served on the boards of ArQule,directors of Texas Instruments Incorporated since 2004 and Cardinal Health, Inc., Veeva Systems since 2009. Ms. Cox previously served as the chairman of the board of directors of electroCore, Inc., from July 2018 to March 2020 and Vigilant Biosciences,Array BioPharma, Inc., a private company. From 2014 from August 2018 to 2017, Mr. BarabeJuly 2019, and served on the board of directors of Opexa Therapeutics, Inc. Mr. Barabe retiredCelgene Corporation from 2009 to November 2019. Ms. Cox received a B.S. from the Massachusetts College of Pharmacy and was a registered pharmacist. The Company believes Ms. Cox’s vast experience as a pharmaceutical executive and member of multiple boards of directors in June 2013 from his positionthe biotechnology industry as Executive Vice President and Chief Financial Officerwell as her knowledge of Affymetrix, Inc., a biotechnology company. Previously, from July 2006 until March 2010, he was Senior Vice President and Chief Financial Officer of Human Genome Sciences, Inc. From 2004corporate strategy qualifies her to 2006, heserve on the Company’s Board.

Aymeric Sallin, M.S. has served as Chief Financial Officera member of Regent Medical Limited, a U.K.-based, privately owned, surgical supply company.our Board of Directors since 2008. Mr. BarabeSallin has served with Novartis AG from 1982 through August 2004 in a succession of senior executive positions in finance and general management, most recently as the Chief FinancialExecutive Officer of Sandoz GmbH,NanoDimension, a venture capital firm, since 2002 and is the generic pharmaceutical subsidiaryfounder of Novartis.that firm. Since 2014, Mr. BarabeSallin has served as a strategic advisory board member of the École Polytechnique Fédérale de Lausanne, or EPFL. Since 2002, Mr. Sallin has worked to promote nanotechnology around the world, and has received the NSTI Fellow Award and 2012 EPFL Alumni award for his contribution to the field of nanotechnology. He currently serves as a board member of numerous private companies, including H55, Inc., View, Inc., CROCUS Technology and Tarveda Therapeutics. Mr. Sallin is also a member of the Swiss Academy of Engineering Science. Mr. Sallin received his B.B.A. degreeMaster’s in Physical Engineering from the University of Massachusetts (Amherst) and his M.B.A. degree from the University of Chicago.EPFL in Lausanne, Switzerland. Mr. Barabe’s experience as a senior financial executive of life sciences companies andSallin’s extensive knowledge of our business and the pharmaceutical and biotech industriesnanomedicine field contributed to our Board of Directors’ conclusion that he should serve as a director of the Company.

Continuing Members of the Board of Directors

Class I Directors (Terms Expire at 2023 Annual Meeting of Stockholders)

The current members of the Board of Directors who are Class I Directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Served as a Director Since | | Position(s) with Selecta |

| Scott D. Myers | | 55 | | 2019 | | Director |

| Timothy A. Springer, Ph.D. | | 73 | | 2016 | | Director |

| Patrick Zenner | | 74 | | 2017 | | Director |

The principal occupations and business experience, for at least the past five years, of each Class I nominee for election at the Annual Meeting are as follows:

|

| | | | | | | | | | |

| CARSTEN BRUNN, PH.D.SCOTT D. MYERS | Age | 4855 |

Carsten Brunn, Ph.D.Scott D. Myers has served as our President, Chief Executive Officer anda member of our Board of Directors since DecemberJune 2019. Mr. Myers most recently served as president and chief executive officer of AMAG Pharmaceuticals, Inc., from April 2020 through its acquisition by Covis Group in October 2020. Previously, Mr. Myers served as chief executive officer and chairman of the board of Rainier Therapeutics, formerly known as BioClin Therapeutics, an oncology biotechnology company focused on late-stage bladder cancer from June 2018 until January 2020, as chief executive officer and member of the board of directors of Cascadian Therapeutics, Inc., an oncology company, from April 2016 through its acquisition by Seattle Genetics in March 2018. Prior to joining Selecta Biosciences, Inc., Dr. Brunn was the PresidentCascadian, Mr. Myers served as chief executive officer of Aerocrine AB, a medical device company, from 2011 through its acquisition by Circassia Pharmaceuticals for the Americas Region andplc in 2015. He is currently a member of the Global Pharmaceutical Executive Committee at Bayer AG,board of directors of Trillium Therapeutics Inc., a pharmaceuticalpublicly traded oncology company, since January 2017. Previously,which he served as President of Bayer Pharmaceuticalsjoined in Japan, a role he held since March 2013. He also served as the ChairmanApril 2021, and of the European Federationboard of Pharmaceutical Industriesdirectors and Associations (EFPIA) Japan, an organization representing innovative pharmaceutical companies in Japan. Dr. Brunn has held a numberaudit committee of senior leadership positions at Eli Lilly, Novartis, Basilea and Bausch and Lomb in Europe, Asia and the United States. He currently servesHarpoon Therapeutics since August 2018. Mr. Myers previously served on the Boardboard of Directorsdirectors of the Biotechnology Innovation Organization (BIO). Dr. Brunn holds a Ph.D. in ChemistryCascadian Therapeutics from the University of Hamburg

and a Master of Science in Pharmaceutical Sciences from the University of Freiburg. He also studied at the University of Washington under a research scholarship and completed his executive education at London Business School. Dr. Brunn's2016 through 2018. Mr. Myers’ experience as a senior executive of life sciences companies and knowledge of the pharmaceutical and biotechnology industries contributed to our Board of Directors'Directors’ conclusion that he should serve as a director of the Company.

CONTINUING MEMBERS OF THE BOARD OF DIRECTORS:

CLASS I DIRECTORS (TERMS TO EXPIRE AT THE 2020 ANNUAL MEETING)The current members of the Board of Directors who are Class I Directors are as follows:

|

| | | | | |

| Name | | Age | | Served as a Director Since | Position(s) with Selecta |

| Timothy A. Springer, Ph.D. | | 71 | | 2016 | Director |

| Patrick Zenner | | 72 | | 2017 | Lead Director |

The principal occupations and business experience, for at least the past five years, of each Class I Director are as follows:

|

| | | |

| TIMOTHY A. SPRINGER, PH.D. | Age | 7173 |

Timothy A. Springer, Ph.D., has served as a member of our Board of Directors since June 2016 and as a scientific advisor to us since December 2008. Since 1989, Dr. Springer has served as the Latham Family Professor at Harvard Medical School. He has also served as Senior Investigator in the Program in Cellular and Molecular Medicine at Boston Children’s Hospital since 2012, and as Professor of Biological Chemistry and Molecular Pharmacology at Harvard Medical School and Professor of Medicine at Boston Children’s Hospital since 2011. Dr. Springer was the Founder of LeukoSite, a biotechnology company acquired by Millennium Pharmaceuticals in 1999. Additionally, he is a founder, investor and board member of Scholar Rock and Morphic Therapeutic. Dr. Springer is a member of the National Academy of Sciences and his honors include the Crafoord Prize, the American Association of Immunologists Meritorious Career Award, the Stratton Medal from the American Society of Hematology, and the Basic Research Prize from the American Heart Association. Dr. Springer received a B.A. from the University of California, Berkeley, and a Ph.D. from Harvard University. Dr. Springer’s extensive knowledge of our business and the nanomedicine field contributed to our Board of Directors’ conclusion that he should serve as a director of the Company.

Patrick Zenner has served as a member of our Board of Directors since June 2017, andalso serving as our Lead Director sincefrom June 2018.2018 to November 2019. Mr. Zenner retired in 2001 from the position of President and Chief Executive Officer of Hoffmann-La Roche Inc., North America, a pharmaceutical company based in Nutley, New Jersey.N.J. Mr. Zenner held various executive positions during his 32-year career with the company. Mr. Zenner is currently a member of the board of trustees of Creighton University and is Chairman of the board of trustees of Fairleigh Dickinson University. In addition, Mr. Zenner is Chairman of the board and a director of both ArQule, Inc. and West Pharmaceutical Services, Inc. From 2002 until January 2020, Mr. Zenner served as Chairman of the board and a director of ArQule, Inc. Until its sale in 2012, Mr. Zenner was a director of Par Pharmaceuticals, Inc. In 2010, he resigned from the boards of Geron Corporation, Xoma Ltd. and Exact Sciences, Inc. Until its sale in September 2009, Mr. Zenner was a director of CuraGen Corporation. Mr. Zenner received a B.S./B.A. from Creighton University and an M.B.A. from Fairleigh Dickinson University. Mr. Zenner’s extensive experience as a senior pharmaceutical executive and board member to numerous companies in the biotechnology industry contributed to our Board of Directors’ conclusion that he should serve as a director of the Company.our company.

CLASS II DIRECTORS (TERMS TO EXPIRE AT THE 2021 ANNUAL MEETING)

Class III Directors (Terms Expire at 2022 Annual Meeting of Stockholders)

The current members of the Board of Directors who are Class IIIII Directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Served as a Director Since | | Position(s) with Selecta |

| Timothy C. Barabe | | 68 | | 2016 | | Director |

| Carsten Brunn, Ph.D. | | 50 | | 2018 | | President and Chief Executive Officer |

|

| | | | | |

| Name | | Age | | Served as a Director Since | Position(s) with Selecta |

| Omid Farokhzad, M.D. | | 50 | | 2007 | Chairman of the Board |

| Amir Nashat, Ph.D. | | 46 | | 2008 | Director |

| Aymeric Sallin | | 45 | | 2008 | Director |

The principal occupations and business experience, for at least the past five years, of each Class IIIII Director are as follows:

|

| | | | | | | | | | |

| OMID FAROKHZAD, M.D.TIMOTHY C. BARABE | Age | 5068 |

Omid Farokhzad, M.D. is one of our co-founders andTimothy C. Barabe has served as a member of our Board of Directors since 2007. Dr. Farokhzad currentlyJuly 2016. Mr. Barabe also serves on the boards of Veeva Systems Inc. and Vigilant Biosciences, Inc., a private company. From 2001 to January 2020, Mr. Barabe served on the board of directors of ArQule, Inc., and from 2014 to 2017, Mr. Barabe served on the board of directors of Opexa Therapeutics, Inc. Mr. Barabe retired in June 2013 from his position as Executive Vice President and Chief Financial Officer of Affymetrix, Inc. Previously, from July 2006 until March 2010, he was Senior Vice President and Chief Financial Officer of Human Genome Sciences, Inc. From 2004 to 2006, he served as Chief Financial Officer of Regent Medical Limited, a U.K.-based, privately owned, surgical supply company. Mr. Barabe served with Novartis AG from 1982 through August 2004 in a succession of senior executive positions in finance and general management, most recently as the Chief ExecutiveFinancial Officer for Seer Biosciences, a biotechnology company, since February 2018. From 2004 to February 2018, he was a Professor at Harvard Medical School and directedof Sandoz GmbH, the Center for Nanomedicine at Brigham and Women’s Hospital. He has authored over 160 papers and is an inventorgeneric pharmaceutical subsidiary of over 200 issued and pending patents. In addition to Selecta, he previously co-founded BIND Therapeutics (Nasdaq: BIND, acquired by Pfizer), Tarveda Therapeutics and Seer. He is a 2018 Fellow of the National Academy of Inventors. He is a recipient of the 2016 Ellis Island Medal of Honor and the 2014 Golden Door AwardNovartis. Mr. Barabe received his B.B.A. degree from the International InstituteUniversity of New England for his scientific, societal, and economic contributions to America as an immigrant. He is also the recipient of the 2013 RUSNANOPRIZE, one of the largest international nanotechnology prizes for his work on nanomaterial surface modification, and the 2012 Ernst & Young New England Entrepreneur of the Year award. Dr. Farokhzad currently serves on the Board of Directors of Seer Biosciences, Tarveda Therapeutics and Placon Therapeutics. From 2006 to 2014, Dr. Farokhzad served on the Board of Directors of BIND Therapeutics, Inc. He received his M.D. and M.A. from Boston UniversityMassachusetts (Amherst) and his M.B.A. degree from MIT Sloan Schoolthe University of Management. Dr. Farokhzad's extensiveChicago. Mr. Barabe’s experience as a senior financial executive of life sciences companies and knowledge of our businessthe pharmaceutical and the nanomedicine field and his medical trainingbiotech industries contributed to our Board of Directors'Directors’ conclusion that he should serve as a director of the Company.

|

| | | | | | | | | | |

| AMIR NASHAT, SC.D.CARSTEN BRUNN, PH.D. | Age | 4650 |

Amir Nashat, Sc.D.,Carsten Brunn, Ph.D. has served as aour President, Chief Executive Officer and member of our Board of Directors since 2008.December 2018. Prior to joining Selecta Biosciences, Inc., Dr. NashatBrunn was the President of Pharmaceuticals for the Americas Region and a member of the Global Pharmaceutical Executive Committee at Bayer AG, a pharmaceutical company, since January 2017. Previously, he served as President of Bayer Pharmaceuticals in Japan, a role he held since March 2013. He also served as the Chairman of the European Federation of Pharmaceutical Industries and Associations (EFPIA) Japan, an organization representing innovative pharmaceutical companies in Japan. Dr. Brunn has beenheld a Partnernumber of senior leadership positions at Polaris Partners, a venture capital firm, since 2009Eli Lilly, Novartis, Basilea and focuses on investmentsBausch and Lomb in Europe, Asia and the life sciences.United States. He currently serves on the Boardboard of Directorsdirectors of Fate Therapeutics, aTyr Pharma, Syros Pharmaceuticals, Scholar Rockthe Biotechnology Innovation Organization (BIO). Dr. Brunn holds a Ph.D. in Chemistry from the University of Hamburg and several private companies. Dr. Nashat hasa Master of Science in Pharmaceutical Sciences from the University of Freiburg. He also served as a director of Receptos, BIND Therapeutics, as well as Adnexus Therapeutics (acquired by Bristol-Myers Squibb Company) and other private companies. Dr. Nashat completed his Sc.D. as a Hertz Fellow in Chemical Engineering at MIT with a minor in biology. Dr. Nashat earned both his M.S. and B.S. in materials science and mechanical engineeringstudied at the University of California, Berkeley.Washington under a research scholarship and completed his executive education at London Business School. Dr. Nashat’s extensiveBrunn’s experience as a venture capitalistsenior executive of life sciences companies and board memberknowledge of numerous companies in the pharmaceutical and biotechnology industryindustries contributed to our Board of Directors’ conclusion that he should serve as a director of the Company.

Aymeric Sallin has served as a memberTable of our Board of Directors since 2008. Mr. Sallin has served as the Chief Executive Officer of NanoDimension, a venture capital firm, since 2002 and is the founder of the firm. Since 2014, Mr. Sallin has served as a strategic advisory board member of the École Polytechnique Fédérale de Lausanne, or EPFL. Since 2002, Mr. Sallin has worked to promote nanotechnology around the world, and has received the NSTI Fellow Award and 2012 EPFL Alumni award for his contribution to the field of nanotechnology. He currently serves as a board member of H55, Inc., View, Inc., CROCUS Technology, Tarveda Therapeutics, and other private companies. Mr. Sallin is also a member of the Swiss Academy of Engineering Science. Mr. Sallin received his Master's in Physical Engineering from EPFL in Lausanne, Switzerland. Mr. Sallin's extensive knowledge of our business and the nanomedicine field contributed to our Board of Directors’ conclusion that he should serve as a director of the Company.Contents

PROPOSAL 2

- Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019.2021. Our Board has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of Ernst & Young LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Ernst & Young LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2018.2020. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit relatedother services. A representative of Ernst & Young LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Ernst & Young LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2020.2022. Even if the appointment of Ernst & Young LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Ernst & Young LLP, we do not expect any broker non-votes in connection with this proposal.

Recommendation of the Board of Directors

RECOMMENDATION OF THE BOARD OF DIRECTORSThe Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

|

| |

Ü | The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

|

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed the Company’s audited financial statements for the fiscal year ended December 31, 20182020 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by statement on Auditing Standards No. 1301, as adopted by the Public Company Accounting Oversight Board (“PCAOB”).

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable PCAOB requirements regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from Selecta Biosciences, Inc. The Audit Committee also considered whether the independent registered public accounting firm’s provision of certain other non-audit related services to the Company is compatible with maintaining such firm’s independence.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018.2020.

| | | | | |

|

THE AUDIT COMMITTEE OF THE BOARD OF

DIRECTORS OF SELECTA BIOSCIENCES, INC. |

|

| Timothy C. Barabe (Chair) |

| Carrie S. Cox |

Amir Nashat, Ph.D. |

| |

| Patrick Zenner |

Independent Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees of Ernst & Young LLP, our independent registered public accounting firm, billed to the Company for each of the last two fiscal years for audit services and for other services:

| | | | | | | | | | | | | | |

| Fee Category | | 2020 | | 2019 |

Audit Fees(1) | | $ | 1,067,199 | | | $ | 824,313 | |

| | | | |

Tax Fees(2) | | 88,200 | | | 20,000 | |

All Other Fees(3) | | 1,985 | | | 4,255 | |

| Total Fees | | $ | 1,157,384 | | | $ | 848,568 | |

|

| | | | | | | | |

| Fee Category | | 2018 | | 2017 |

| Audit Fees | | $ | 580,077 |

| | $ | 728,395 |

|

| Audit-Related Fees | | — |

| | 20,500 |

|

| Tax Fees | | 20,000 |

| | 17,340 |

|

| All Other Fees | | 3,530 |

| | 1,995 |

|

| Total Fees | | $ | 603,607 |

| | $ | 768,230 |

|

AUDIT FEES

(1)Audit fees consist of fees billed for the audit of our annual consolidated financial statements, the review of the interim consolidated financial statements, and related services that are normally provided in connection with registration statements.

AUDIT-RELATED FEES

For 2020, audit fees also include services related to the Swedish Orphan Biovitrum AB agreement and debt restructuring. Audit-related fees consist of fees for(2)assurance and related services that are traditionally performed by an independent registered public accounting firm, including special procedures required to meet certain regulatory requirements.

Tax fees consist of fees for professional services, including tax consulting and compliance performed by Ernst & Young LLP.

For 2020, tax fees also include services related to the Swedish Orphan Biovitrum AB agreement and debt restructuring.

All other fees are thoseassociated with services not captured in the other categories.categories, including the utilization of a research tool provided by Ernst & Young LLP.

AUDIT COMMITTEE PRE-APPROVAL POLICY AND PROCEDURESAudit Committee Pre-Approval Policy And Procedures The Audit Committee has adopted a policy (the “Pre-Approval Policy”) which sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by the independent auditor may be pre-approved. The Pre-Approval Policy generally provides that we will not engage Ernst & Young LLP to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by Ernst & Young LLP has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence. The Audit Committee will also consider whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. On an annual basis, the Audit Committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by Ernst & Young LLP without first

obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations. All of the services provided by Ernst & Young LLP during 20182020 and 20172019 were pre-approved.

Executive Officers

The following table identifies our current executive officers:

|

| | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

Carsten Brunn, Ph.D. 1 | | 4850 | | President and Chief Executive Officer |

Bradford D. Dahms 2 | | 33 | | Chief Financial Officer |

Lloyd Johnston, Ph.D. 23 | | 5153 | | Chief Operating Officer and Senior Vice President, Research and Development |

Takashi Kei Kishimoto, Ph.D. 34 | | 5961 | | Chief Scientific Officer |

Elona KoganPeter G. Traber, M.D. 45

| | 4966 | | General Counsel and Secretary |

Stephen Smolinski 5

| | 54 | | Chief CommercialMedical Officer |

1 See biography on page 810 of this proxy statement.

2 Bradford D. Dahms has served as our Chief Financial Officer since September 2019. Prior to joining Selecta, Mr. Dahms served as Senior Vice President - Healthcare Investment Banking at Cantor Fitzgerald & Co., an investment bank, from April 2014 to August 2019. He also served as an analyst at RBC Capital Markets from 2012 to 2014, and at JPMorgan Chase & Co. from 2010 to 2012. Mr. Dahms holds a Bachelor of Science degree in economics from The Ohio State University.

23 Lloyd Johnston, Ph.D. has served as our Chief Operating Officer and Senior Vice President, Research and Development since January 2014. Dr. Johnston served as Selecta’s Senior Vice President of Pharmaceutical Research, Development and Operations from 2011 to 2013 and Vice President of Pharmaceutical Research from July 2008 to 2011. Prior to joining Selecta, Dr. Johnston was Vice President of Operations for Alkermes, Inc. from 2004 to 2008, and served in several roles, including Director of Manufacturing, from 1999 to 2004, with responsibility for process development, scale-up, and clinical manufacturing for pulmonary and sustained release injectable products, as well as leadership of Alkermes’ manufacturing facility in Chelsea, MA. At Alkermes, Dr. Johnston was also a project leader and member of Steering Committees for numerous products through various stages of development from Phase 1 through registration. Dr. Johnston was an original member of Advanced Inhalation Research Inc., or AIR, a private company formed in 1998 and acquired by Alkermes in 1999. Prior to joining AIR, Dr. Johnston was a lecturer in the Department of Chemical Engineering at the University of New South Wales in Sydney, Australia. He received his B.Sc. in Chemical Engineering from Queen’s University in Ontario, Canada, and his M.S. and Ph.D. in Chemical Engineering from MIT.

3 4 Takashi Kei Kishimoto, Ph.D. has served as our Chief Scientific Officer since June 2011. Prior to joining Selecta, Dr. Kishimoto was Vice President of Discovery Research at Momenta Pharmaceuticals, Inc., where he served in several leadership positions from March 2006 to June 2011 and led a multidisciplinary team in advancing both novel and complex generic products for inflammation, oncology, and cardiovascular disease. He served as Senior Director of Inflammation Research at Millennium Pharmaceuticals, Inc. from 1999 to 2006, where he provided the scientific leadership for four programs in clinical development, and before his time at Millennium Pharmaceuticals, he was the Associate Director of Research at Boehringer Ingelheim Pharmaceuticals. Dr. Kishimoto has published over 60 peer-reviewed articles in scientific journals, including Nature, Science, Cell and the New England Journal of Medicine. Dr. Kishimoto received his B.A. from New College of the University of South Florida and his Ph.D. in Immunology from Harvard University.

45 Elona Kogan has served as our General Counsel and Secretary since March 2019. Ms. Kogan joined Selecta after most recently serving as General Counsel and Head of Government Relations at ARIAD Pharmaceuticals, Inc., a rare disease oncology company, from July 2016 to April 2017, where she was a key executive through the acquisition of the company by Takeda Pharmaceuticals Company Limited. Prior to joining ARIAD, May 2011 to August 2015, Ms. Kogan led the legal and government affairs functions of Avanir Pharmaceuticals, Inc. a publicly traded pharmaceutical company, dedicated to developing treatments for central nervous system disorders, where she played a central role in the strategic acquisition of the company by Otsuka Pharmaceutical Co. Ltd. Prior roles included positions of increasing responsibility at King Pharmaceuticals, Inc., Bristol-Myers Squibb, and Bergen Brunswig Corporation. Ms. Kogan is also a member of the board of directors of a biotechnology company and serves as the Chairperson of the Compensation Committee, and a member of the Audit Committee. Ms. Kogan is a graduate of the SCALE program at Southwestern University School of Law. Ms. Kogan graduated cum laude from Columbia University, Barnard College, with a B.A. in economics.

5 Stephen SmolinskiPeter G. Traber, M.D. has served as our Chief CommercialMedical Officer since October 2017. Mr. Smolinski previouslyAugust 2020. Prior to joining Selecta Biosciences in 2020, Dr. Traber spent 2 years as a Partner at Alacrita Consulting, providing drug development consulting services and served as the Vice Presidentinterim Chief Medical Officer (CMO) for Morphic Therapeutic supporting integrin inhibitor drug development. For the 8 years prior, he was CEO, CMO, and Headon the Board of Galectin Therapeutics developing drugs for fibrotic liver disease and cancer. He served as CMO and SVP of Clinical Development and Medical Affairs at GSK, CEO of Baylor College of Medicine, and Chair of Medicine and CEO of the North American RheumatologyUniversity of Pennsylvania Health System. He received his MD from Wayne State School of Medicine, a BS in Chemical Engineering from the University of Michigan, and a certificate in Medical Leadership from Wharton Business UnitSchool. He is currently an Adjunct Professor of Medicine at Sanofi Genzyme, a pharmaceutical corporation, from 2015 to 2017. Prior to this, he served as Group Vice Presidentthe University of Immunology & Inflammation, Global Strategic Unit at Sanofi from 2013 to 2015. Mr. Smolinski also previously held senior commercial roles at Roche-Genentech, Bristol-Myers Squibb, Johnson & JohnsonPennsylvania and Savient Pharmaceuticals. Mr. Smolinski received a B.S. in health care administration from Oregon State University.serves on the board of Caladrius Biosciences.

None of our executive officers is related to any other executive officer or to any of our directors.

Corporate Governance

Our Board of Directors has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics and charters for our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our current committee charters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics in the “Corporate Governance” section of the “Investors & Media” page of our website located at www.selectabio.com, or by writing to our Secretary at our offices at 480 Arsenal Way,65 Grove Street, Watertown, Massachusetts 02472.

Our Board of Directors currently consists of 7eight members: Göran Ando, M.D., Timothy C. Barabe, Carsten Brunn, Ph.D., Timothy C. Barabe, Omid Farokhzad, M.D., Amir Nashat, Ph.D.,Carrie S. Cox, Scott D. Myers, Aymeric Sallin, Timothy Springer, Ph.D. and Patrick Zenner. As set forth in our Restated Certificate of Incorporation, the Board of Directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors.

All of our directors and Class IIIII director nominees, other than Carsten Brunn, Ph.D. and Omid Farokhzad, M.D., qualify as “independent” in accordance with the listing requirements of The Nasdaq Global SelectStock Market LLC (“Nasdaq”). The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our Board of Directors has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board of Directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management.management, including that each of Dr. Springer and Mr. Sallin are affiliated with certain of our significant stockholders. Dr. Brunn is not independent because he is the President and Chief Executive Officer of Selecta. Dr. Farokhzad is not independent because he receives consulting fees under the terms of his consulting agreements with Selecta. There are no family relationships among any of our directors or executive officers.

The Nominating and Corporate Governance Committee is primarily responsible for searching for qualified director candidates for election to the Board and filling vacancies on the Board. To facilitate the search process, the Nominating and Corporate Governance Committee may solicit current directors and executives of the Company for the names of potentially qualified candidates or ask directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates, or consider director candidates recommended by our stockholders. Once potential candidates are identified, the Nominating